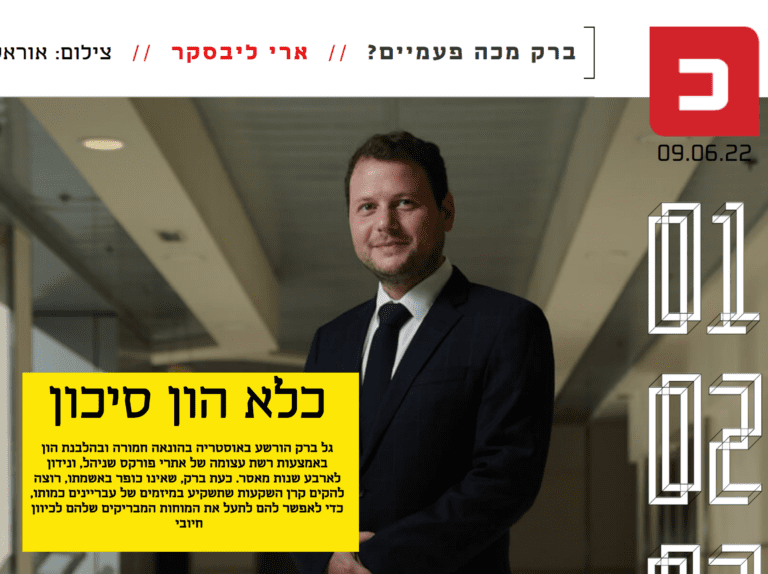

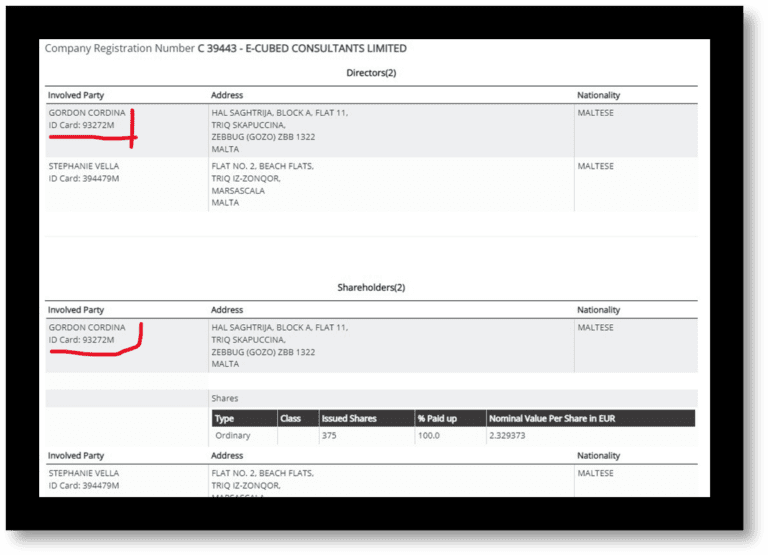

That’s no joke! The Israeli Gal Barak was sentenced in Sept 2020 as the mastermind of cybercrime organization E&G Bulgaria to several years in prison and some €4 million in restitution payments to victims of the scams. He has been on parole for a few months. In an interview with the Israeli Calcalist, Barak claimed that he would have compensated his victims as ordered by the court. That is a lie, he has not compensated any of his victims. Instead, he evidently used the stolen millions to establish a $20 million cybercrime fund.

The German Trials

German prosecutors have also filed criminal charges against Gal Barak claiming that he was the ringleader of the E&G Bulgaria cybercrime organization that defrauded German citizens. His lawyers have appealed against the indictment. The case is currently before the European Court of Justice and is due to be decided on July 6, 2022. In the event of an indictment in Germany, Barak will probably serve a few more years in prison.

The New Austrian Charges

The public prosecutor’s office in Austria has also brought a new charge against Gal Barak (screenshot left). The prosecutor in charge, Guenter Goessler, accuses Barak of not telling the truth in the trial against his wife Marina Barak (previously Marina Andreeva) and lying to the court. This is a criminal act and for this Barak should be punished with up to 3 years in prison.

Marina Barak was acquitted in the trial, perhaps in part because of Barak’s lies. The prosecution objected to the acquittal of Marina Barak. A decision on this by the Supreme Court in Austria is pending.

The German prosecutors intend to file charges against both Gal Barak and Marina Barak. It will be an interesting few months.

The Cybercrime Fund

Gal Barak is simply an obstinate liar and cybercriminal. That is a simple truth. Dressed in a dark business suit with a black tie, he lets himself be photographed by the Israeli Calcalist and gives a ridiculous interview. In this interview, Barak claims that he regrets his bad past and, after serving his prison sentence, would have repented and also compensated his victims – as ordered by the court. This is a lie! He did neither of them! When asked by FinTelegram, it was confirmed that Gal Barak had not yet paid a euro to his victims.

However, he is apparently using the stolen millions – investigations suggest more than $200 million – to make a $20 million cybercrime fund. The fund is supposed to use the creative potential and drive of convicted cybercriminals to make investors rich. That sounds like a dangerous threat, doesn’t it?

I’m not a bad man, I’m a good man. I acted bad, but I’m not a bad man. There’s also a Gal who did good, who contributed and helped. I only fell once, and I do not want to fall again. Not everyone is like that.

Gal Barak on his personality

In the interview, Gal Barak told Calcalista that at the beginning he aimed to raise $10 million for his cybercrime fund but he was approached by a family that wanted to invest $20 million in exchange for involvement on the fund’s board. The board would also include representatives of investors and lawyers. Barak would not want money from the fund, he says.

Contempt Of Justice

Gal Barak is a human symbol of the failure of justice in the fight against cybercrime. He can afford the most expensive lawyers with the money stolen from his victims. He shows no remorse, does not pay back his victims despite the court verdict, and instead sets up a cybercrime fund and publicly mocks the justice system and his victims via an interview.