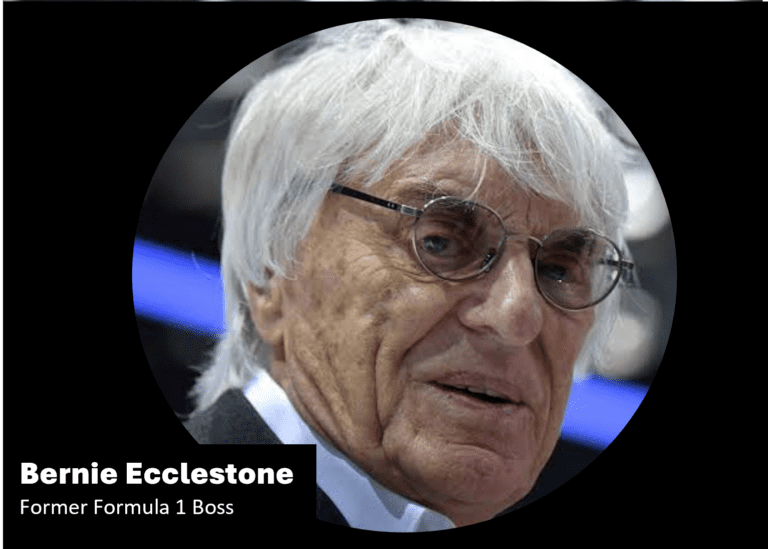

Bernie Ecclestone, the ex-head of Formula 1, has been handed a suspended prison sentence after admitting to fraud charges. The 92-year-old failed to disclose over £400 million in a Singapore trust to UK tax officials in 2015. Ecclestone consented to a civil agreement to pay nearly £653 million to HM Revenue and Customs (HMRC). As a result, he received a 17-month prison sentence, which has been suspended for two years.

For many years, Bernie Ecclestone was the driving force behind Formula One, operating it with a minimal team from its Kensington, London base. The sport’s business thrived on personal negotiations and handshake agreements. However, this very approach seems to have led to Ecclestone’s recent legal troubles.

Ecclestone faced the consequences of his actions in Southwark crown court, London, where he admitted to tax fraud. His attempt to conclude an HM Revenue and Customs (HMRC) investigation into his financial affairs in a 2015 meeting backfired when he provided misleading information. This resulted in a 17-month suspended prison sentence.

In addition to the sentence, Ecclestone is mandated to pay £652.6 million to HMRC and cover prosecution expenses amounting to £74,000. This comes after his confession of not disclosing £400m in assets to the UK’s tax body. Appearing in court in a grey suit, the soon-to-be 93-year-old Ecclestone stated his guilty plea.

This marks a significant decline for Ecclestone, who, from the late 1970s to January 2017, held sway in race paddocks and secured preferential deals with global leaders, including Tony Blair and Vladimir Putin. His influence played a pivotal role in elevating Formula One to a globally recognized media entity, while he retained control over its commercial and sporting aspects.

By 2005, Ecclestone began relinquishing financial control, selling a portion of the business to US private equity firm CVC. While CVC allowed Ecclestone to continue his operations, the dynamics shifted in 2017 when Liberty Media acquired Formula One. Ecclestone’s traditional business approach clashed with contemporary corporate governance standards, leading to his removal post-acquisition.

Ecclestone’s legal challenges aren’t new. In 2014, he paid £60m (without admitting guilt) to conclude a bribery case in Germany. In 2022, he faced arrest in Brazil for possessing a firearm on a private plane but was released on bail. HMRC initiated its investigation into Ecclestone’s finances in 2012.

Ecclestone’s defense highlighted his advancing age and potential health risks associated with imprisonment. While acknowledging the severity of Ecclestone’s actions, the judge considered factors like his age, health, and the potential impact on his young child before delivering the sentence.