The year 2024 is poised to become the epoch of a renewed fintech wave, driven by an impressive surge in investments in 2021. In the second quarter alone, a staggering $30.8 billion in venture capital flowed into fintechs, marking an unprecedented quarterly milestone. This not only underscores investors’ confidence but also highlights the escalating significance of fintechs in the global financial market. In this article, we delve into the essence of fintech – what they are and the transformative impact they wield on the financial landscape.

Understanding Fintech:

Fintechs, short for financial technology companies, are at the forefront of revolutionizing the financial industry by seamlessly blending technology with traditional financial services. These agile and innovative entities leverage cutting-edge technologies such as artificial intelligence, blockchain, cloud computing, and mobile applications. Their mission is to challenge and enhance established financial models, making transactions, investments, and financial management more efficient, accessible, and customer-centric.

Fintech’s Evolutionary Path:

In the second quarter of 2021, the fintech industry experienced an unparalleled financial boom, with 88 venture capital funding rounds globally, each in the triple-digit million-dollar range. Notably, four out of the top five investments were directed towards European fintech companies, indicating a shift in the dynamics of this sector on the global stage.

During this period, fintech startups and scale-ups secured a remarkable $30.8 billion in funding, marking a 30% increase from the already robust first quarter of the same year. This surge not only highlights the enduring allure of the fintech industry for investors but also signifies a trend towards more substantial and impactful funding rounds.

The essence of fintech’s impact can be measured not only in monetary terms but in the transformative evolution of financial services. These entities are redefining how individuals manage their finances, facilitating swift and secure transactions, pioneering alternative credit assessment methods, and introducing digital asset management solutions.

Fintech’s Impactful Ventures:

The 88 funding rounds in the triple-digit million-dollar range constituted 70% of the entire fintech funding in the second quarter. Particularly noteworthy is the increase in the average size of a fintech funding round, rising from $37 million in the first quarter to an impressive $47 million in the second quarter. This dramatic upswing reflects the growing maturity and confidence of investors in the promising business models of fintechs.

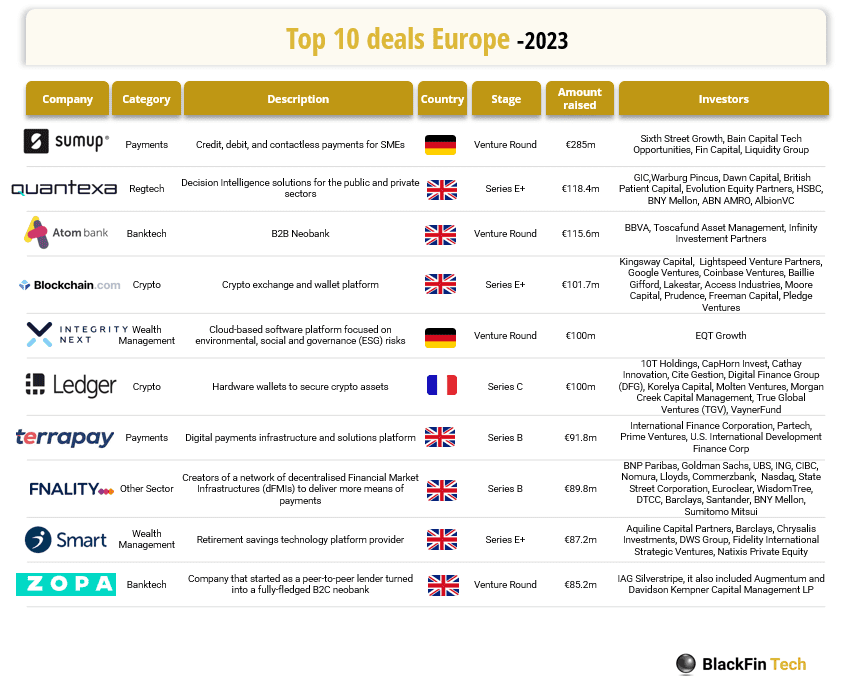

(These were the 10 biggest fintech deals in Europe in 2023 (source: Blackfin))

The fintech surge of 2024 is not merely a financial trend but a transformative force reshaping the financial landscape. Fintechs, with their innovative technologies and customer-centric approaches, are at the forefront of this revolution. As investments continue to pour in and the fintech ecosystem matures, the impact on how we experience and engage with financial services will be profound.