Published: February 2026

Wearables are no longer step counters. They are behavioral feedback systems.

Among serious performance and longevity trackers, two names dominate the conversation: Whoop and Oura.

Both promise recovery insights, sleep optimization, and better daily decision-making. But they approach the problem very differently.

If you are deciding between them — or wondering whether using both makes sense — here is a structured comparison.

The Core Philosophical Difference

The biggest distinction is not technical. It is philosophical.

Whoop is built around strain, performance, and training load. It is athlete-first.

Oura is built around recovery, sleep quality, and long-term physiological trends. It is lifestyle-first.

This difference shapes everything else.

Whoop: The Performance Engine

Whoop tracks:

- Daily strain (cardiovascular load)

- Recovery score (HRV, resting heart rate, sleep quality)

- Continuous heart rate monitoring

- Respiratory rate

- Skin temperature deviations

- Sleep performance

What makes Whoop unique is its strain model. It translates cardiovascular effort into a measurable daily score and compares it to recovery status.

The core logic is simple:

- If recovery is high — push harder.

- If recovery is low — reduce strain.

Whoop is particularly effective for:

- Structured training programs

- HIIT and endurance athletes

- Overtraining prevention

- Stress-load monitoring

Limitations:

- No display screen

- Limited lifestyle features

- Subscription-based model

- Less refined sleep staging than Oura

Oura: The Recovery Intelligence System

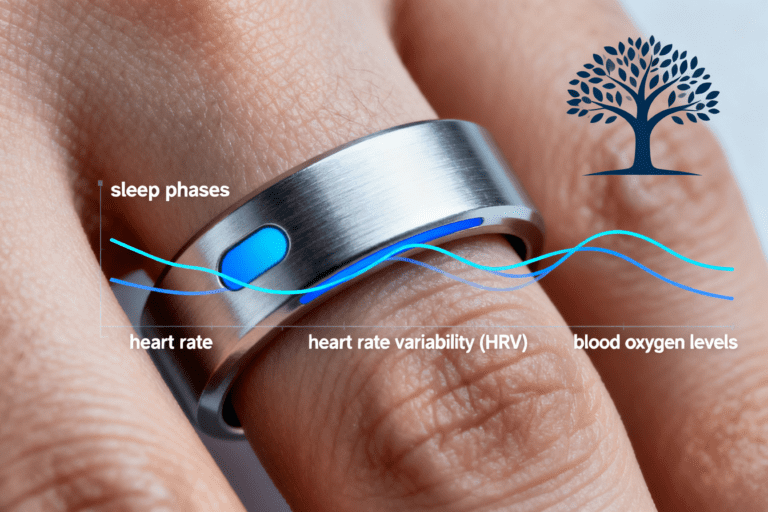

Oura tracks:

- Sleep stages (deep, REM, light)

- Heart rate variability (HRV)

- Resting heart rate

- Body temperature trends

- Respiratory rate

- Readiness score

- Activity patterns

Oura’s strength lies in sleep analytics and recovery trends. Its nighttime data collection is among the most refined in consumer wearables.

Oura is especially effective for:

- Sleep optimization

- Longevity tracking

- Travel recovery and jet lag management

- Hormonal cycle insights

- Long-term physiological trend detection

Limitations:

- Less detailed workout strain modeling

- Limited real-time performance feedback

- Not built primarily for intense training cycles

Accuracy and Data Interpretation

Both devices rely heavily on heart rate variability and resting heart rate as recovery indicators.

In general:

- Whoop is stronger in continuous daytime monitoring and strain tracking.

- Oura is stronger in sleep stage detection and temperature analysis.

Neither replaces medical-grade diagnostics. Both provide directional insights that are useful when interpreted consistently over time.

Can You Use Whoop and Oura Together?

Yes — and for certain users, it makes sense.

Whoop measures how hard you push. Oura measures how well you recover.

Combined, they provide:

- Strain optimization (Whoop)

- Sleep depth and recovery trends (Oura)

- Temperature deviation alerts (Oura)

- Daily cardiovascular load analysis (Whoop)

For biohackers, high-performing founders, or individuals under sustained stress, the combination can offer a more complete physiological picture.

However, for most users, one device is sufficient.

When to Choose Whoop

- You train intensely multiple times per week.

- You want structured strain guidance.

- You care about performance output.

- You want to manage overtraining risk.

When to Choose Oura

- Sleep is your primary focus.

- You travel frequently.

- You optimize for longevity rather than performance.

- You prefer a discreet wearable.

The Real Question: What Are You Optimizing?

If you are optimizing for athletic output, Whoop is stronger. If you are optimizing for sleep and long-term resilience, Oura is stronger. If you are deeply data-driven and performance-focused, using both may be justified.

The critical point: Wearables do not improve health. They improve awareness.

What you do with that awareness determines the outcome.