ByteDance, the Chinese tech behemoth behind the global phenomenon TikTok, has recently self-valued at an astounding $300 billion. This valuation, revealed through a share buyback program, marks a significant milestone in the company’s financial journey and warrants a closer look at its operations, challenges, and future prospects.

Company Background

Founded in 2012 by Zhang Yiming and Liang Rubo in Beijing, ByteDance has rapidly ascended to become one of the world’s most valuable private companies. The founders, former college roommates at Nankai University, have steered the company to remarkable success in just over a decade. Key facts:

- Headquarters: Beijing, China

- Founded: 2012

- Founders: Zhang Yiming and Liang Rubo

- Main products: TikTok, Douyin, Toutiao, Xigua

Financial Performance and Valuation

ByteDance’s financial trajectory has been nothing short of impressive:

- Current valuation: ~$300 billion (November 2024)

- Previous valuations:

- December 2023: $268 billion

- October 2023: ~$225 billion

- Valuation growth: Approximately 33% increase from October 2023 to November 2024

- Global revenue (2023): $110 billion

- Year-over-year revenue growth: 30%

The company has been conducting share buybacks since 2022, with the most recent offering shares at $180.70, a 12.9% increase from the previous buyback price.

The TikTok Conundrum

While ByteDance’s financial performance is robust, its flagship product TikTok faces significant challenges:

- Regulatory Pressure: A U.S. federal law requires ByteDance to sell TikTok to an American owner by mid-January 2025 or face a ban.

- Data Security Concerns: There are ongoing worries about potential Chinese government access to U.S. user data.

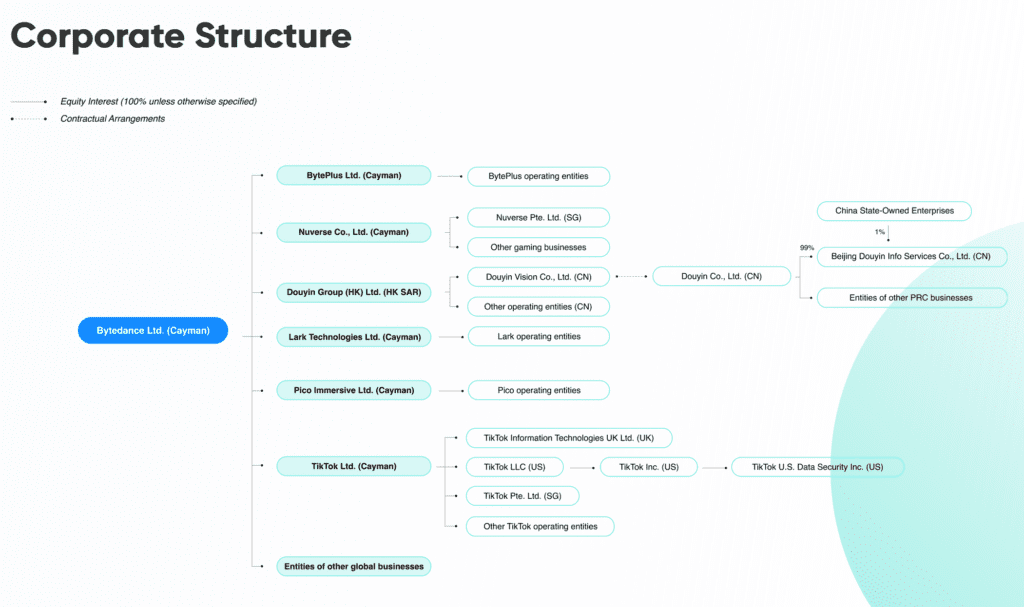

- Ownership Structure: Recent revelations show that ByteDance owns 100% of TikTok Ltd., contradicting previous claims of a more complex ownership structure involving U.S. entities.

- Project Texas: TikTok has invested over $1.5 billion in this initiative to store U.S. user data domestically, but its effectiveness in alleviating concerns remains uncertain.

- Chinese Government Ties: Like other large Chinese tech companies, ByteDance has a Chinese Communist Party committee within its corporate structure, and the Chinese government holds a small stake in its main Chinese subsidiary.

Analysis and Outlook

ByteDance’s $300 billion valuation reflects its strong market position and financial performance. However, several factors could impact its future valuation:

- Regulatory Risks: The potential forced sale or ban of TikTok in the U.S. market could significantly affect ByteDance’s valuation and global reach.

- Geopolitical Tensions: Ongoing U.S.-China tensions may create additional hurdles for ByteDance’s international operations.

- Credibility Challenges: Recent revelations about TikTok’s ownership structure may undermine trust in key markets.

- Market Saturation: As the social media landscape evolves, ByteDance will need to innovate to maintain its growth trajectory.

- Diversification: ByteDance’s ability to expand beyond TikTok and succeed in other markets will be crucial for long-term growth.

Conclusion

ByteDance’s $300 billion valuation underscores its position as a major player in the global tech industry. However, the company faces significant challenges, particularly regarding TikTok’s future in the U.S. market. The coming months will be critical as ByteDance navigates regulatory hurdles, addresses data security concerns, and strives to maintain its impressive growth. Investors should closely monitor developments in U.S. regulations, ByteDance’s corporate structure adjustments, and its ability to diversify revenue streams beyond TikTok.