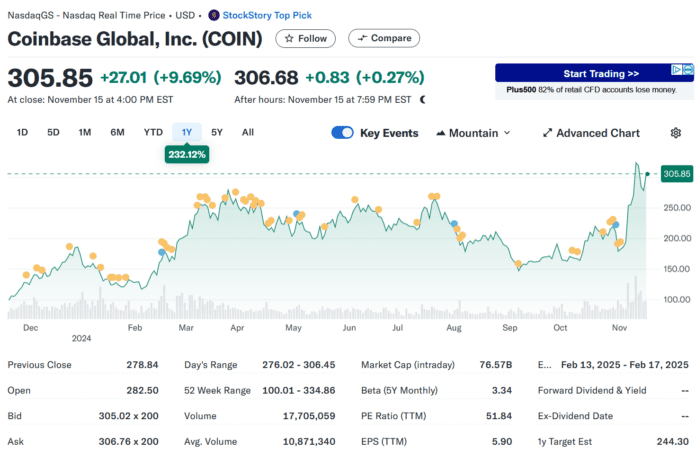

Hey Gen Z investors! The crypto segment is currently in a bull cycle again after the halving in the spring of 2024 and Donald Trump’s victory in the U.S. elections. Against this backdrop, the U.S. crypto exchange Coinbase has performed very strongly in recent weeks and recently jumped back above the $300 mark. Here’s what you need to know:

Financial Snapshot

Coinbase just dropped its Q3 2024 results, and it’s a mixed bag of wins and challenges:

- Total revenue: $1.2 billion (up 79% year-over-year, but down 17% from Q2)

- Transaction revenue: $572.5 million (up 98% year-over-year, down 27% from Q2)

- Subscription and services revenue: $556.1 million (up 66% year-over-year, down 7% from Q2)

The company’s strong market position is reflected in its financial performance. In the first three quarters of 2024, Coinbase generated approximately $5.7 billion in annualized revenue. An impressive figure that underscores the company’s ability to capitalize on the growing interest in the digital asset sector.

What’s Hot

Innovation Game Strong

Coinbase isn’t just sitting pretty. They’re pushing the envelope with:

- Base: Their Layer 2 solution is gaining serious traction. DeFi activity on Base is exploding, with address activity skyrocketing from 143,600 in Q2 to 405,700 in Q3 2024.

- USDC: The stablecoin co-founded by Coinbase saw its global transaction volume double to a whopping $22 trillion year-over-year.

Market Position

Coinbase remains a top dog in the crypto exchange world. They’re bridging the gap between traditional finance and the Wild West of crypto, which is crucial as digital assets go mainstream.

Challenges to Watch

Regulatory Rollercoaster

The crypto world is still figuring out its relationship with regulators. Coinbase is in the thick of it, facing off with the SEC in court. They’re pushing for clearer rules, which could be a game-changer for the industry.

Competition Heating Up

As crypto gets more popular, everyone wants a piece of the pie. Traditional financial institutions and fintech companies are jumping into the crypto pool, which could squeeze Coinbase’s market share.

Looking Ahead

Despite some short-term bumps, analysts are pretty hyped about Coinbase’s future. Some are even talking about potential revenue of $10 billion and earnings per share hitting $12 in the near term.

Why It Matters to Gen Z

- Innovation Leadership: Coinbase is at the forefront of crypto innovation, which aligns with Gen Z’s tech-savvy nature.

- Potential Growth: The crypto market is still young, and Coinbase is well-positioned to ride the wave of future adoption.

- Regulatory Advocacy: Their push for clearer regulations could help shape a more stable crypto future.

- Volatility: Remember, crypto is still a rollercoaster. Coinbase’s performance can swing wildly based on market conditions.

- Long-term Vision: Coinbase is thinking big about the future of finance, which could resonate with Gen Z’s forward-thinking mindset.

Despite Coinbase‘s elevated valuation, we are placing the U.S. crypto exchange on our green list for crypto investments, anticipating further price growth in the current bullish market environment. While market corrections are always a possibility, our outlook for Coinbase remains positive through the end of Q1 2025.