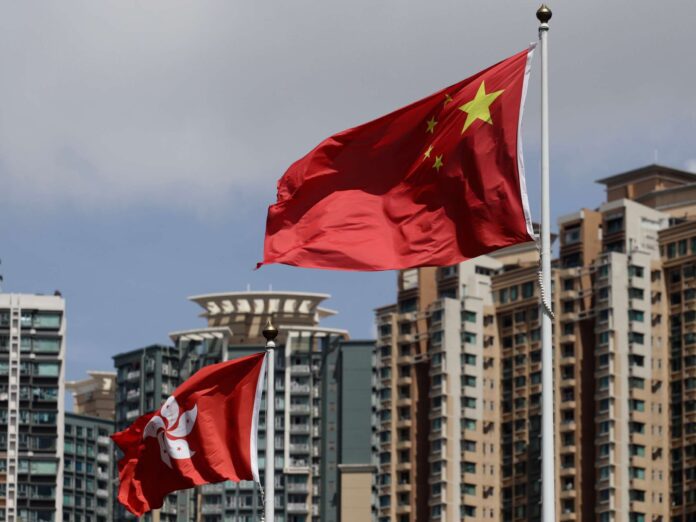

In an unprecedented move signaling Hong Kong’s ambition to become a frontrunner in the digital assets domain, the city’s financial regulator is on the verge of approving the first batch of Bitcoin spot Exchange-Traded Funds (ETFs). This groundbreaking development, as reported by Reuters, would mark Hong Kong as the first location in the Asia-Pacific region to sanction a cryptocurrency-backed, exchange-based investment fund. The approval by the Securities and Futures Commission (SFC) is expected to be announced later this month, placing Hong Kong at the forefront of the race to establish itself as the digital assets hub for Asia.

The introduction of these ETFs represents a significant milestone for the region, indicating a growing acceptance and institutionalization of digital assets. With four applications already submitted by entities based in mainland China, including notable names such as Harvest Fund Management, China Asset Management, and Bosera Asset Management, Hong Kong’s financial landscape is set for a transformative shift. The SFC has already shown its support for the burgeoning crypto market by granting approval to Harvest and CAM to provide virtual-asset-related fund management services.

By giving the green light to these crypto ETF applications, Hong Kong is not merely expanding its financial ecosystem but is also strategically positioning itself as a leader in the global digital assets sector. This move mirrors actions taken by the United States, which earlier this year approved its first spot Bitcoin ETFs. Despite the approvals in the U.S. being a direct result of legal action taken by several crypto trading firms, they have successfully garnered over $58 billion in assets.

The adoption of crypto ETFs in Hong Kong is anticipated to significantly impact the region’s financial market. Although the market size is unlikely to match the scale seen in the U.S., the introduction of crypto ETFs is expected to invigorate Hong Kong’s finance sector. This comes at a crucial time as the city seeks to navigate the challenges posed by China’s economic downturn and the residual effects of the pandemic, including stringent travel restrictions that have hampered the ability of Hong Kong asset managers to attract and retain top talent.

As the SFC prepares to finalize its approvals, the financial world watches closely. The successful launch of Bitcoin spot ETFs in Hong Kong could not only enhance the city’s status as a global financial hub but also pave the way for increased innovation and investment in the crypto space within the Asia-Pacific region. This development underscores the growing importance of digital assets in the contemporary financial landscape and marks an important step towards the integration of traditional and digital finance.