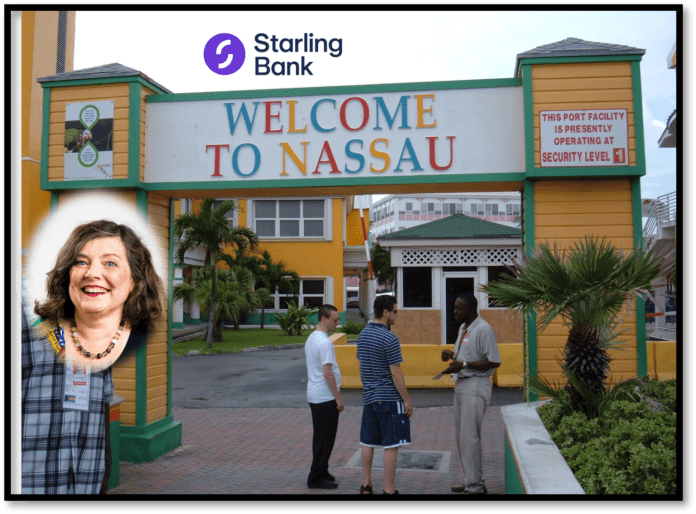

FinTelegram exposed the secretive Austrian billionaire who controls the UK FinTech unicorn Starling Bank. In June 2015, the reclusive Austrian investor Harald McPike met its founder, Anne Boden, aboard his yacht in the Bahamas to discuss his investment in the then freshly squeezed neobank. McPike allegedly made his first fortune as a professional blackjack player. The former hedge fund manager reportedly invested at least £133m in Starling Bank for nearly two-thirds of the shares and is the controlling person and beneficial owner of Starling Bank says the UK Companies House.

The Dominant Shareholder

According to The Guardian, Harald McPike’s stake has since been reduced to 36%, while Anne Boden was diluted down to a remaining 4.9% stake. Founder and CEO Anne Boden lost control of Starling Bank in April 2019, say filings at UK Companies House. With her 4.9%, she is now one of several small shareholders in the unicorn. According to a report of fn financial news, McPike is represented on the Starling board by Lázaro Campos, the former chief executive of Swift, and the New Zealand-based accountant Marcus Traill.

However, it is unclear whether McPike’s position had been diluted in a capital raising, or sold to new investors, who invested money into Starling after its incredible growth during the Covid-19 crisis. That latest internal fundraising of £130.5 million pushed the bank’s valuation from more than £1bn last spring to £2.5bn earlier this year, pricing McPike’s remaining stake at more than £900m.

McPike has made the Starling investment via his special purpose vehicle JTC Starling Holdings, managed by the McPike Family Office, based in the Bahamas, where there is no income or capital gains tax.

Starling is expected to report its first annual profit in the coming weeks, a milestone for the neobank and the UK FinTech scene. In 2019, Starling Bank had lent just £23 million, but by June 2021, it had issued £1.6bn of bounce-back lending. In the Covid-19 pandemic, Starling has increased its total business account pool to 470,000, which is 8% of the small business banking market in the UK.