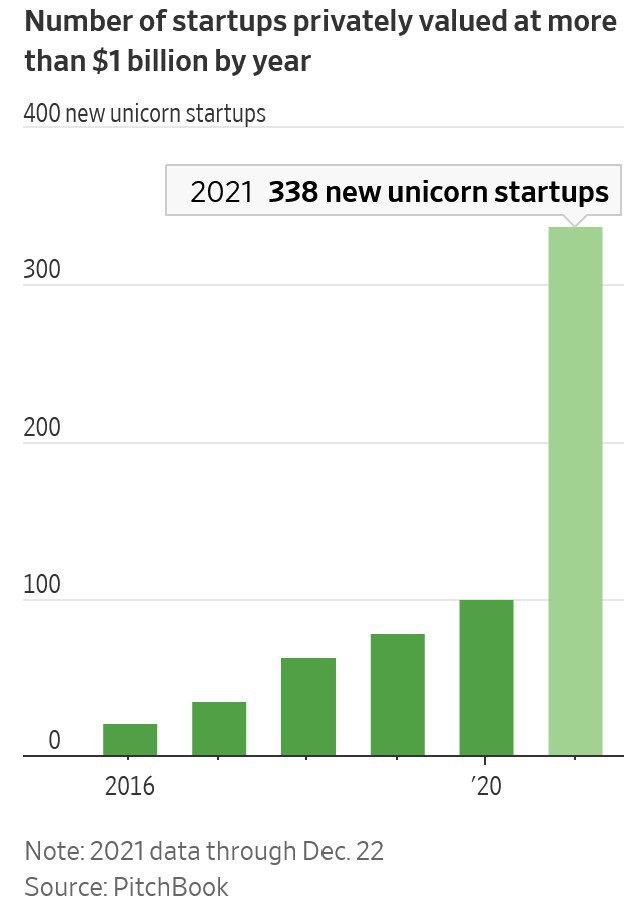

The Wall Street Journal (WSJ) reports that investors continue to make hundreds of billions of dollars available to startups, a cash pile that promises to inject a torrent of money into early-stage firms in 2022 and beyond. A large chunk of this cash pile is held in SPACs waiting to merge with the next startup unicorn.

Special-purpose acquisition companies (SPAC) have taken Wall Street and Silicon Valley by storm as a new way to quickly raise cash and go public. A SPAC is a shell firm that raises money and lists on a stock exchange with the sole intent of merging with a private firm to take it public. After regulators approve the deal, the private firm replaces the SPAC in the stock market. One reason for SPACs’ sudden ubiquity is that startups are allowed to make business projections when going public that aren’t allowed in traditional IPOs.

According to WSJ, these SPACs raised about $12 billion in each of October and November, roughly doubling their clip from each of the previous three months. In December 2021, three SPACs a day are being created. While that is below the first quarter’s record pace, it brings the total amount held by the hundreds of SPACs seeking private companies to take public in the next two years to roughly $160 billion.

The cash committed to venture-capital firms and private-equity (PE) firms focused on rapidly growing companies is ballooning. So-called dry powder hit about $440B for venture capitalists and roughly $310B for growth-focused PE firms earlier this month.

“The availability of SPAC capital and of private capital gives companies options, but ultimately, the problems are caused by bringing the wrong company public or the wrong valuation,” said Mike Ryan, CEO of Bullet Point Network, a financial analytics company.