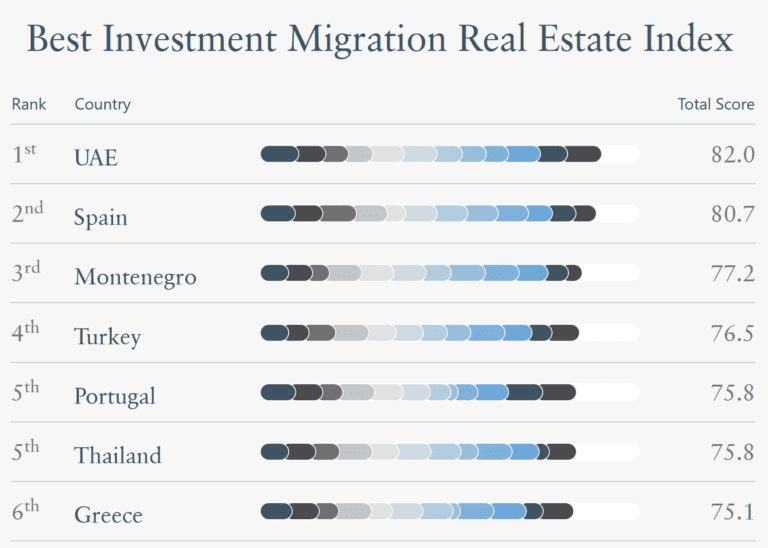

We live in the age of modern nomads in which mobility is one of our fundamental values. Real estate comes with residence or citizenship rights in another jurisdiction when purchased through an investment migration program. According to the Best Investment Migration Real Estate Index established by Henley & Partners, Dubai is the favorite destination for such a real estate investment.

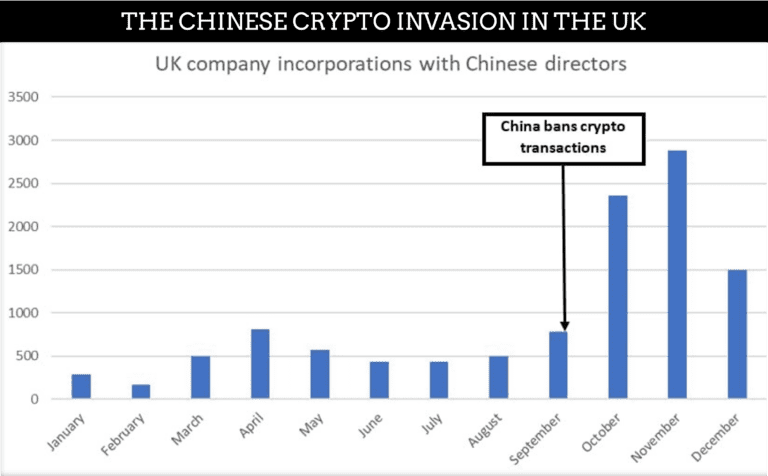

The index highlights the 16 most important residence and citizenship by investment programs offering real estate investment. It uses more than 30 parameters and 300 data points to score and compare these highly attractive program options according to key considerations for investors. The criteria include the reputation of the home country, its quality of life, GDP, the minimum real estate investment amount, potential rental income, associated property costs, application processing efficiency, the real estate holding period, residence requirements, restrictions, and salability, as well crypto friendliness, which is gaining in importance among global investors.

Using this interactive index, investors can compare real estate–linked investment migration options according to the factors that matter most to you and your family. It will help you identify the most suitable destinations for your portfolio diversification in terms of real estate and residence.