The escalating tensions between Israel and Iran are casting a long shadow over global financial markets, with potential repercussions that could affect everything from oil prices to investment strategies. As the situation unfolds, understanding the economic implications of this conflict is crucial for investors and policymakers alike.

Oil Market Volatility

The Middle East, as a pivotal region for global oil supply, is significantly affected by geopolitical tensions. Recent developments suggest that any conflict involving Iran could disrupt oil supplies and inflate prices. Iran’s support of various militant groups and its contentious relationship with Israel could lead to heightened sanctions and increased military activity, affecting global oil prices and market stability (euronews) (CSIS).

Global Economic Impact

The potential for this conflict to escalate into a wider regional war could have catastrophic effects on the global economy. Analysts predict that a full-blown conflict could trim nearly $1 trillion from the global GDP, tipping the world into a recession. The uncertainty and risk associated with military escalations could lead to higher oil prices, possibly surpassing $150 per barrel, further straining global economic conditions (euronews) (Middle East Institute).

Investment Shifts and Safe Havens

In times of geopolitical uncertainty, investors often seek refuge in safe-haven assets. Gold and the US dollar have traditionally been the beneficiaries during such crises. Current trends indicate a significant uptick in these assets as investors brace for potential instability. This shift is compounded by the broader economic implications of the conflict, including impacts on energy prices and inflation, which could reshape investment portfolios globally (euronews) (J.P. Morgan | Official Website).

Regional Economic Disparities

The Middle East and North Africa (MENA) region faces its own unique economic challenges, exacerbated by the conflict. While some Gulf countries may manage due to their oil wealth, others like Egypt and Jordan could face severe economic distress. The conflict might worsen existing inequalities and hinder economic development across the region (Middle East Institute).

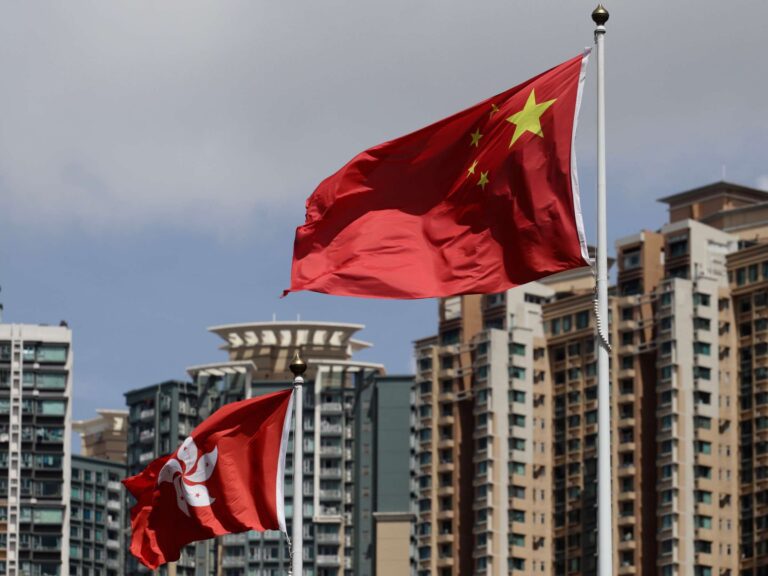

U.S. and Global Policy Implications

The United States, amidst its own internal political and economic challenges, may find its ability to influence outcomes in the Middle East reduced. The ongoing conflict could limit U.S. foreign policy maneuverability as it deals with other global challenges, such as its relations with China and Russia, and domestic economic issues like high debt levels and interest rates (Financial Horse) (Middle East Institute).

Conclusion

The Israel-Iran conflict presents a complex challenge to global stability and economic growth. As the situation develops, the international community must monitor these tensions closely, considering both the immediate and long-term economic impacts. Investors should remain vigilant, adapting their strategies to navigate through these turbulent times effectively.