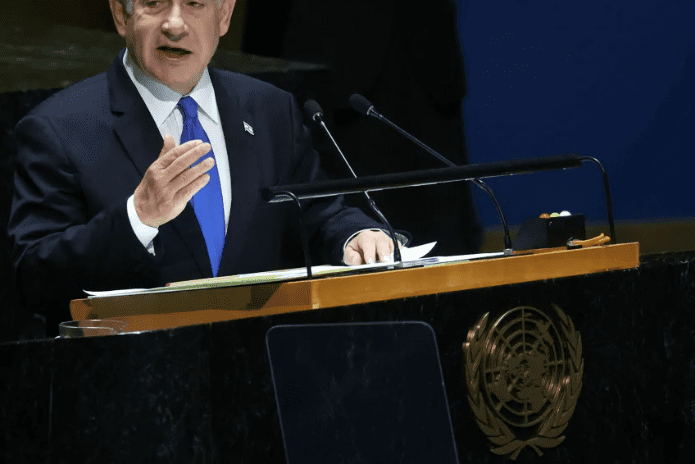

As the world leaders converge on New York for the 79th session of the United Nations General Assembly (UNGA), the global community finds itself at a crossroads, grappling with ongoing conflicts, climate change, and the need for UN reform. This year’s assembly, themed “Unity in Diversity for the Advancement of Peace, Sustainable Development, and Human Dignity for Everyone, Everywhere,” underscores the urgency for global cooperation in the face of unprecedented challenges.

Key Discussions and Initiatives at UNGA 79:

- Gaza, Ukraine, and Sudan Conflicts: The ongoing wars in Gaza, Ukraine, and Sudan have cast a shadow over the assembly. UN Secretary-General António Guterres has called for a spirit of compromise among member states, highlighting the Security Council’s paralysis due to veto power wielded by the P5 (United States, Russia, China, France, UK). The conflicts not only test the UN’s capacity to maintain peace but also its relevance in resolving contemporary geopolitical disputes.

- Climate Change: Amidst these conflicts, climate change remains a critical agenda item. The General Assembly is set to discuss sea-level rise and other environmental issues, with vulnerable nations pushing for more aggressive climate action. This reflects a broader recognition that environmental security is integral to global peace.

- UN Reform and the ‘Pact for the Future’: The assembly sees discussions on reforming the UN, particularly the Security Council, to reflect current global power dynamics better. The ‘Pact for the Future’, part of the Summit of the Future, aims at providing a blueprint for addressing global challenges, including rethinking the structure of global governance to be more inclusive and effective.

- Migration and Human Mobility: Under the theme, migration is highlighted as both a challenge and an opportunity. The International Organization for Migration (IOM) is advocating for policies that recognize migrants’ contributions to development and peace.

- Health and Development: The impact of health crises on development, particularly the focus on reducing zero-dose children in vaccinations, indicates a commitment to health security as a cornerstone of sustainable development.

Anticipated Outcomes:

- Increased Humanitarian Aid: There’s a strong call for better access to deliver humanitarian aid, especially in Gaza, where restrictions have severely limited aid deliveries.

- Ceasefire Calls: Voices from within and outside the UN are urging for immediate ceasefires in conflict zones, emphasizing the protection of civilians.

- Reform Commitments: While reform might not see immediate structural changes, there’s an expectation for commitments towards more democratic representation within UN bodies, particularly the Security Council.

- Global Digital Compact: Expected as part of the ‘Pact for the Future’, this could set new standards for digital cooperation, affecting technology governance worldwide.

Challenges Ahead:

The UNGA, while a platform for dialogue, faces skepticism regarding its effectiveness due to the veto power in the Security Council, which often deadlocks decision-making on critical issues. The absence or lower representation of leaders from major powers like Russia and China might also affect the momentum of discussions.

Conclusion:

UNGA 79 stands as a testament to the world’s commitment to dialogue amidst diversity and conflict. While the outcomes might not resolve the immediate crises, the discussions pave the way for future global governance that might be more reflective of today’s world, where peace, development, and human rights are intrinsically linked with environmental stewardship and inclusive global policies. As leaders speak, the world watches, hoping for not just words, but actionable commitments towards a future where unity in diversity is not just a theme but a lived reality.