South Korea has a precarious history of political power transitions, where the fall of presidents has often been as dramatic as their rise. From corruption charges to impeachments and arrests, the country’s democratic framework seems trapped in an endless loop of scandal. With President Yoon Suk-yeol‘s government under fire after the withdrawal of martial law, whispers of impeachment are already in the air, further fueling public distrust in South Korea’s democratic system.

This isn’t an isolated case. South Korea’s recent history reads like a political thriller:

- Kim Dae-jung (1998–2003) – Imprisoned under President No. 3 and sentenced to death under President No. 5 (later pardoned). Nobel Peace Prize laureate.

- Roh Moo-hyun (2003–2008), a progressive president, faced accusations of corruption post-presidency and tragically ended his life in 2009.

- Lee Myung-bak (2008–2013), another former leader, served prison time for embezzlement and bribery charges.

- Park Geun-hye (2013–2016), impeached in 2016 for a corruption scandal involving her confidante, Choi Soon-sil, was later sentenced to 25 years in prison.

Every scandal deepens the divide between the electorate and its leadership. For a generation raised on promises of transparency and accountability, such betrayals have turned democracy into a hollow word.

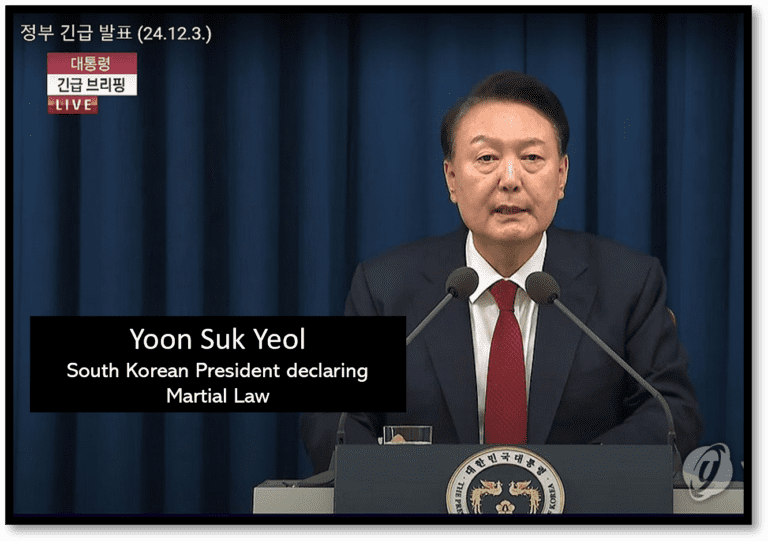

Martial Law and Its Aftermath

The martial law declaration, and its abrupt withdrawal, showcased the fragility of Yoon’s government. What should have been a calculated move to maintain order backfired, revealing a leadership struggling with internal discord and public outrage. The talk of impeachment isn’t surprising; it’s a pattern—political opponents weaponizing the judicial system to seize power under the guise of accountability.

A Tale of Two Democracies: Trump and South Korea

The United States, often held as a beacon of democracy, isn’t immune to this pattern. The events following Donald Trump’s loss to Joe Biden in 2020 bear eerie similarities to South Korea’s volatile political landscape. Trump’s legal battles have become a political spectacle, with indictments ranging from alleged election interference to improper handling of classified documents.

While Trump’s opponents argue these proceedings uphold the rule of law, his supporters claim they’re a calculated effort to eliminate him from the political arena. The erosion of trust in the judicial system is palpable, mirroring the skepticism in South Korea.

Governors, Corruption, and Democracy’s Decline

The long list of convictions of U.S. governors like Rod Blagojevich (Illinois) and Robert McDonnell (Virginia) for corruption and abuse of power further demonstrates democracy’s vulnerabilities. While the judicial apparatus plays a vital role in checks and balances, it also highlights how power can be wielded selectively to dismantle opponents.

Democracy’s Fractured Future

For Millennials and Gen Z, democracy isn’t the sacred institution their parents revered—it’s a crumbling system plagued by nepotism, corruption, and political warfare. Disillusionment isn’t just a feeling; it’s a response to living in systems that fail to deliver.

Both South Korea and the U.S. face a reckoning. Can democracy reinvent itself, or will it continue to alienate the very generations it claims to empower? For now, the pendulum of political power swings violently, leaving citizens as collateral damage in the relentless battle for dominance.

In a world of eroding trust, perhaps the real question isn’t whether democracy will survive but whether it deserves to.