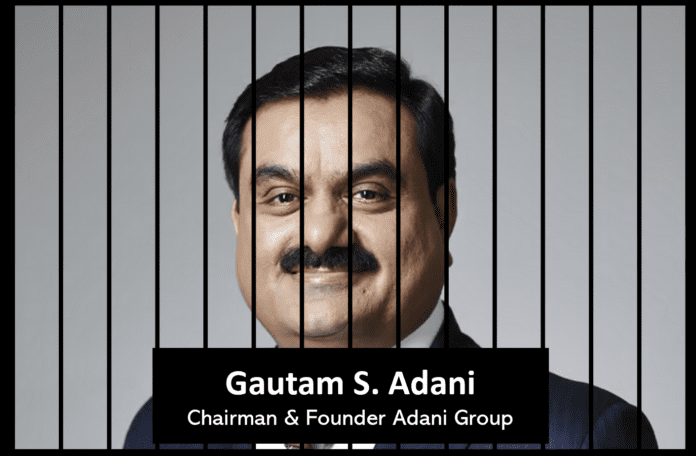

Gautam Adani, once hailed as a symbol of Indian entrepreneurship and the world’s third-richest man, now finds himself at the center of one of the biggest scandals to hit global markets. The Adani Group, a sprawling conglomerate synonymous with India’s economic ascent, is reeling from allegations of fraud, corruption, and financial manipulation that have shattered its market value and Adani’s personal fortune.

The Rise: Adani’s Meteoric Ascent

Born on June 24, 1962, in Ahmedabad, Gujarat, Gautam Adani started with modest beginnings. Leaving college to pursue business ventures, Adani founded Adani Enterprises in 1988, focusing initially on commodity trading. Over the decades, his empire expanded into coal mining, ports, power generation, and renewable energy.

Adani’s ventures propelled him into global prominence, cementing his status as a pioneer of India’s infrastructure boom. By 2022, he operated the country’s largest private port, Mundra, while making inroads into green energy, airports, and agribusiness. His audacious expansion turned him into a billionaire darling of investors worldwide.

The Fall: Hindenburg’s Explosive Allegations

The tides turned in January 2023 when U.S.-based Hindenburg Research, known for targeting corporate fraud, released a scathing report accusing the Adani Group of “decades-long stock manipulation and accounting fraud.” Among the allegations:

- Use of offshore shell companies to artificially inflate stock prices.

- Concealment of debt that could destabilize the group’s financial standing.

The fallout was immediate and brutal. Adani Group companies lost over $150 billion in market value within weeks, marking the steepest collapse of any major conglomerate in modern times. Adani himself saw his net worth nosedive from over $100 billion to nearly half that amount.

Adding fuel to the fire, the Organised Crime and Corruption Reporting Project (OCCRP) released documents in August 2023, alleging that Adani Group insiders used front companies to manipulate share prices—directly contravening Indian securities laws.

The Legal Avalanche: U.S. DOJ and SEC Take Action

The revelations from Hindenburg and OCCRP evidently caught the attention of U.S. regulators. On November 20, 2024, the Department of Justice (DOJ) unsealed an indictment charging Gautam Adani, his brother Sagar Adani, and other top executives with securities and wire fraud. The charges, spanning 2020-2024, allege:

- $250 million in bribes paid to Indian government officials to secure solar energy contracts worth $2 billion in profits.

- Misleading U.S. investors to raise over $3 billion through fraudulent syndicate loans and bond offerings.

Simultaneously, the U.S. Securities and Exchange Commission (SEC) filed a complaint accusing Gautam and Sagar Adani, along with executives from Adani Green Energy and Azure Power Global, of orchestrating a massive bribery scheme. The SEC alleges that Adani executives falsified anti-corruption credentials to secure international financing, deceiving investors globally.

Market Mayhem: Adani’s Empire on the Brink

The DOJ indictment and SEC complaint have sent shockwaves through the markets. Shares of Adani Group companies nosedived, with Adani Enterprises crashing over 20% in a single day. Adani Green Energy bonds fell by as much as 15%, mirroring the Hindenburg-triggered meltdown earlier this year.

Adani’s personal wealth has also been decimated. Once worth over $100 billion, his fortune now stands at $58.5 billion, relegating him to the 25th richest individual globally. While he remains the second-richest Asian, his financial dominance is under siege.

Could Hindenburg Have Sparked the DOJ Investigation?

The timing suggests a clear link between Hindenburg’s revelations and the subsequent legal scrutiny. The January 2023 report served as a catalyst, triggering investor panic and prompting international regulators to probe Adani’s operations. If proven, the allegations could set a precedent for targeting emerging-market conglomerates accused of corruption and fraud.

What’s Next for Adani and the Global Market?

The Adani saga highlights the vulnerabilities of rapidly expanding conglomerates operating in loosely regulated markets. For investors, it’s a cautionary tale about the risks of unchecked growth and opaque corporate governance.

As the DOJ and SEC investigations unfold, Gautam Adani’s once-unassailable empire teeters on the brink. The implications for global markets are profound: heightened scrutiny of ESG investments, tighter regulatory frameworks for emerging markets, and a potential exodus of international capital from India’s corporate giants.

The Cyber Voice will continue to monitor this high-stakes drama, dissecting its ripple effects across industries and borders. Stay tuned for in-depth analyses and breaking updates on the financial scandal of the decade.