The leader of Norway’s Socialist Left Party (SV), Kirsti Bergstø, has ignited a fierce debate over tax compliance and public shaming with her controversial “Wall of Shame” initiative. This strategy, aimed at exposing alleged tax offenders, has thrust a prominent crypto entrepreneur into the spotlight and raised questions about the intersection of politics, taxation, and the rapidly evolving cryptocurrency landscape.

The “Wall of Shame” Strategy

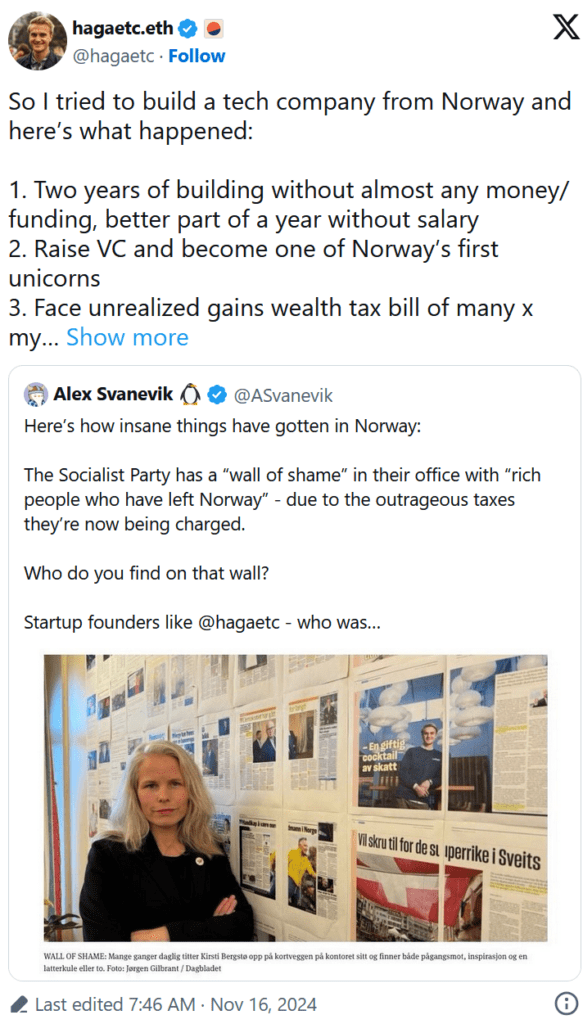

Kirsti Bergstø, in her role as SV leader, has implemented a provocative approach to addressing what her party perceives as tax avoidance among wealthy individuals. The “Wall of Shame” is a public list that names and criticizes those the party believes have not paid their fair share of taxes. This tactic represents a bold move in Norwegian politics, blending public policy with a form of social pressure.

Crypto Entrepreneur in the Crosshairs

One of the most high-profile inclusions on this list is Fredrik Haga, co-founder of the Web3 analytics platform Dune Analytics. Haga’s case has become a focal point in the debate surrounding cryptocurrency taxation:

- Tax Authority’s Valuation: The Norwegian Tax Administration assessed Haga’s crypto holdings at approximately 200 million Norwegian Kroner (NOK) (about $18.7 million).

- Haga’s Contention: In stark contrast, Haga maintains that his actual holdings were worth only around 2 million NOK ($187,000).

This significant discrepancy has led to Haga’s inclusion on the SV’s controversial list and a substantial tax bill.

Implications of Public Shaming

The “Wall of Shame” approach has sparked intense discussions about the ethics and effectiveness of public shaming as a tool for tax compliance:

- Political Strategy: It represents a bold political move by the SV to highlight perceived inequalities in tax contributions.

- Public Perception: The strategy risks oversimplifying complex tax issues and potentially damaging reputations before full legal processes have concluded.

- Crypto Industry Impact: The inclusion of a prominent crypto entrepreneur raises questions about the understanding and treatment of digital assets in traditional tax systems.

Global Attention

The controversy has attracted international attention, including a response from Tesla CEO Elon Musk, who described the case as “Wow, this is crazy” in a tweet. This global interest underscores the wider implications of how different jurisdictions approach cryptocurrency taxation and public accountability.

Broader Implications

The SV’s “Wall of Shame” and its consequences highlight several critical issues:

- Valuation Challenges: The case underscores the difficulties in accurately valuing highly volatile cryptocurrency assets for tax purposes.

- Political Use of Tax Information: It raises questions about the appropriate use of tax information in political discourse and campaigns.

- Public vs. Private Resolution: The strategy brings into question whether tax disputes should be resolved privately or in the court of public opinion.

- Crypto Regulation Gaps: The controversy exposes potential gaps in tax regulations concerning digital assets and the need for clearer guidelines.

Conclusion

Kirsti Bergstø‘s “Wall of Shame” strategy has undoubtedly succeeded in drawing attention to issues of tax compliance, particularly in the cryptocurrency sector. However, it has also sparked a broader debate about the ethics of public shaming, the challenges of crypto asset valuation, and the role of political parties in tax enforcement.

As this situation continues to unfold, it will likely influence discussions on tax policy, cryptocurrency regulation, and political accountability not just in Norway, but globally. The Cyber Voice will continue to monitor these developments, recognizing their potential to shape future approaches to taxation and public policy in the digital age.