Introduction

Financial intelligence magazine FinTelegram published an interesting piece about luxury watches and crypto. In recent years, the luxury watch market has experienced significant turbulence. Parallel to the cryptocurrency boom between 2020 and 2022, the prices of luxury watches also soared, indicating a new trend among millennial and Gen Z investors. This article delves into the development of the secondary market for luxury watches, its peak during the crypto hype, and the subsequent collapse following the downfall of cryptocurrency prices.

The Surge in Luxury Watch Investments

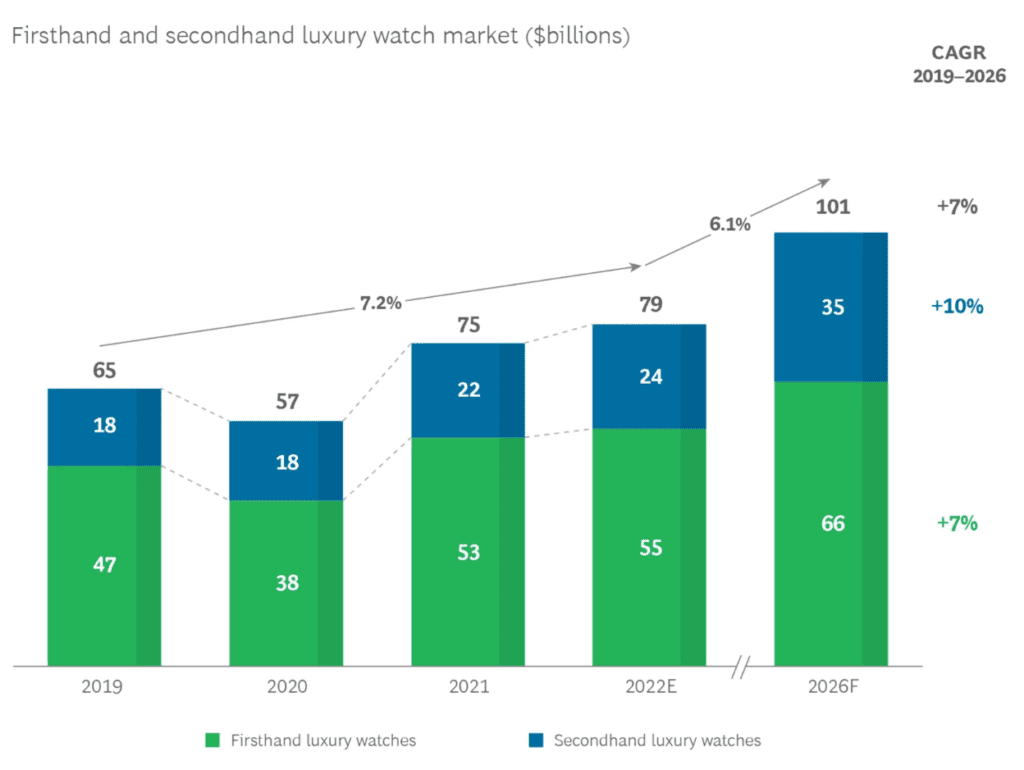

The luxury watch market witnessed a massive increase in demand, particularly among younger investors. According to a Boston Consulting Group (BCG) report, luxury watches represent a $75 billion market, of which the secondary market is 30% and growing.

A report by Grand View Research valued the global luxury watch market at USD 42.21 billion in 2022, with a projected compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. This surge was fueled partly by millennials and Generation Z, who discovered luxury watches as an investment opportunity alongside cryptocurrencies.

A Boston Consulting Group (BCG) report found that 54% of Gen Z and millennial buyers increased their spending on luxury watches in the past two years. This growing interest was not limited to men; women showed a significant inclination towards upgrading their luxury watches, driving companies to expand their offerings for this segment.

The New Alternative Investment Paradigm

This relationship between the crypto and luxury watches markets can be primarily attributed to the investment behaviors of younger generations who are simultaneously engaged in both markets. The following key points underpin this hypothesis:

- Shared Investor Base: The same demographic – millennials and Gen Z – attracted to cryptocurrencies and luxury watches is also likely to engage with luxury watch NFTs. This overlap suggests that investment decisions in one market could influence the others.

- Digital-Physical Asset Fusion: The emergence of luxury watch NFTs creates a bridge between tangible luxury goods and digital assets. Movements in the cryptocurrency market could directly impact the perceived value and demand for luxury watch NFTs, which in turn could influence the traditional luxury watch market.

- Market Dynamics Synergy: The luxury watch market’s shift towards NFTs could be both a result of and a contributing factor to the trends observed in the cryptocurrency market. This synergy could lead to a feedback loop, where the growth of one sector fuels the others.

It can be hypothesized that a resurgence in cryptocurrency market prices, as observed since mid-2023, will not only positively impact the secondary market prices for physical luxury watches but also boost the interest and value of luxury watch NFTs. This trend would reflect the increasing integration of digital and traditional investment assets in the portfolios of younger investors.

Peak and Collapse: A Mirror to the Crypto Market

With the collapse of the first crypto schemes and the start of the crash in crypto prices in spring 2022, the prices of luxury watches on the secondary market also collapsed.

The peak of the luxury watch market coincided with the height of the cryptocurrency craze. In March 2022, the average price of a luxury watch in the secondary market reached a staggering $46,700, with certain models selling for up to five times their retail value. Brands like Rolex, Patek Philippe, and Audemars Piguet saw their iconic models reach record highs. However, this peak was short-lived.

By early December 2023, luxury watch prices in the secondary market plummeted to a near two-year low. According to WatchCharts, a luxury watch price tracker, the average price of a watch sold secondhand has fallen by almost 37% since March 2022.

The downturn was particularly severe for iconic Rolex, Patek Philippe, and Audemars Piguet models. Experts noted that the influx of sellers in response to high prices led to a tripling of supply for the most iconic pieces, contributing to the price drop.

Not a Burst, But a Correction

Despite the sharp decline, experts like Pierre Dupreelle from Boston Consulting Group suggest that this isn’t a bubble burst but a market correction. While prices have fallen significantly from their peak, they remain higher than pre-pandemic levels. As the economy stabilizes, there’s potential for these prices to stabilize and possibly rise again.

Conclusion

The secondary market for luxury watches has undergone significant changes in the past few years, heavily influenced by the trends in cryptocurrency and the pandemic. While the current prices may offer a buying opportunity for a new generation of collectors, it remains to be seen how the market will stabilize in the long term. This trend highlights the evolving nature of investment and luxury spending among younger generations, signaling a shift in traditional investment mindsets.