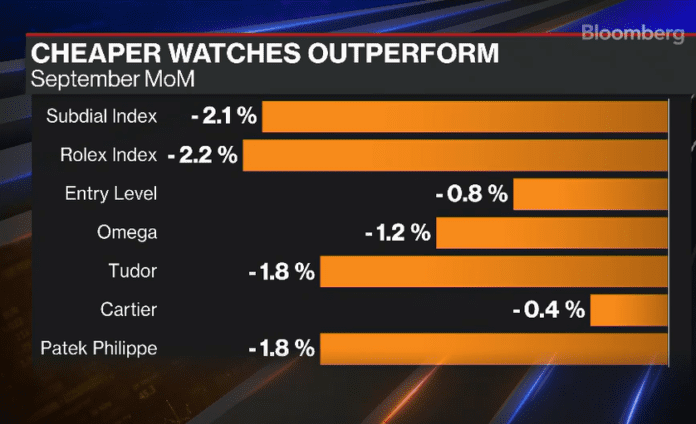

The demand for pre-owned Rolex watches declined in the secondary market last month. In contrast, entry-level models and brands like Cartier and Omega experienced better performance. The Bloomberg Subdial Watch Index reported a 2.2% decrease in the Rolex timepieces index in September. Meanwhile, an index of 100 entry-level watches, usually priced below £7,500 ($9,120), witnessed a 0.8% drop during the same timeframe.

This trend suggests that collectors and enthusiasts are hesitant to invest in highly sought-after models from top Swiss brands, especially after the price surge in 2021 and early 2022. Notably, prices for Rolex, Patek, and other premium pre-owned models reached record highs in the secondary market during the pandemic. However, they began to decline sharply from April 2022, influenced by rising interest rates and the downfall of several cryptocurrencies.

Cartier watches, featuring popular models like the Tank and Santos, performed the best among brand indexes, with only a 0.4% decline. The Omega index, which includes the Speedmaster Moonwatch, decreased by 1.2%. Tudor, Rolex’s more affordable sister brand, saw its index drop by 1.8%.

Over the past six months, lower-priced, entry-level watches have outperformed the overall market, as well as the Rolex and Patek Philippe indexes. The Bloomberg Subdial Watch Index, which comprises the 50 most traded watches by value from Rolex, Patek Philippe, and Audemars Piguet, has decreased by about 5% in six months. In comparison, the Entry-Level 100 index has only fallen by 0.7% during the same period.

The Cartier index, which includes many models priced below £7,500, emerged as the top performer, gaining 2% over six months. However, an exception to this trend is the Rolex sister brand Tudor. Its entry-level priced watches have declined by 4.8% in six months, as per Subdial data.

Despite these trends, most watches in the Bloomberg Subdial Watch Index from Patek, AP, and Rolex continue to command prices on the secondary market higher than their retail price. On the other hand, most entry-level priced models, ranging from brands like Breitling to Cartier to Omega, typically trade below their retail price on the secondary market.In a year-over-year comparison, the Bloomberg Subdial Watch Index has decreased by 12%, while the Entry Level 100 index has seen a 1.2% increase.