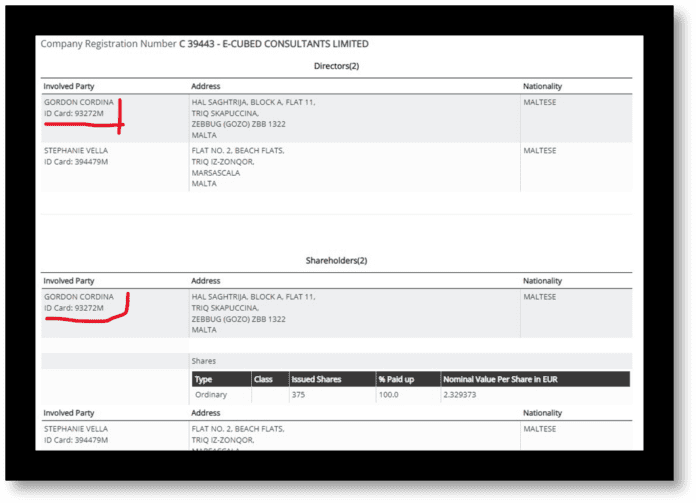

FinTelegram exposed that the Chairman of Malta’s largest Bank, Gordon Cordina, has a nice side hustle through E-Cubed Consultants Limited, a company registered in Malta and operating from its Mosta offices. Gordon Cordina owns half of the shares of E-cubed Consultants Ltd and serves as a director. His partner is Stephanie Vella. The firm’s auditors are RSM Malta Ltd. Fintelegram has received intelligence that clearly shows that Bank of Valletta‘s Chairman also acts as a consultant to the highly controversial Maltese regulator Malta Gaming Authority (MGA).

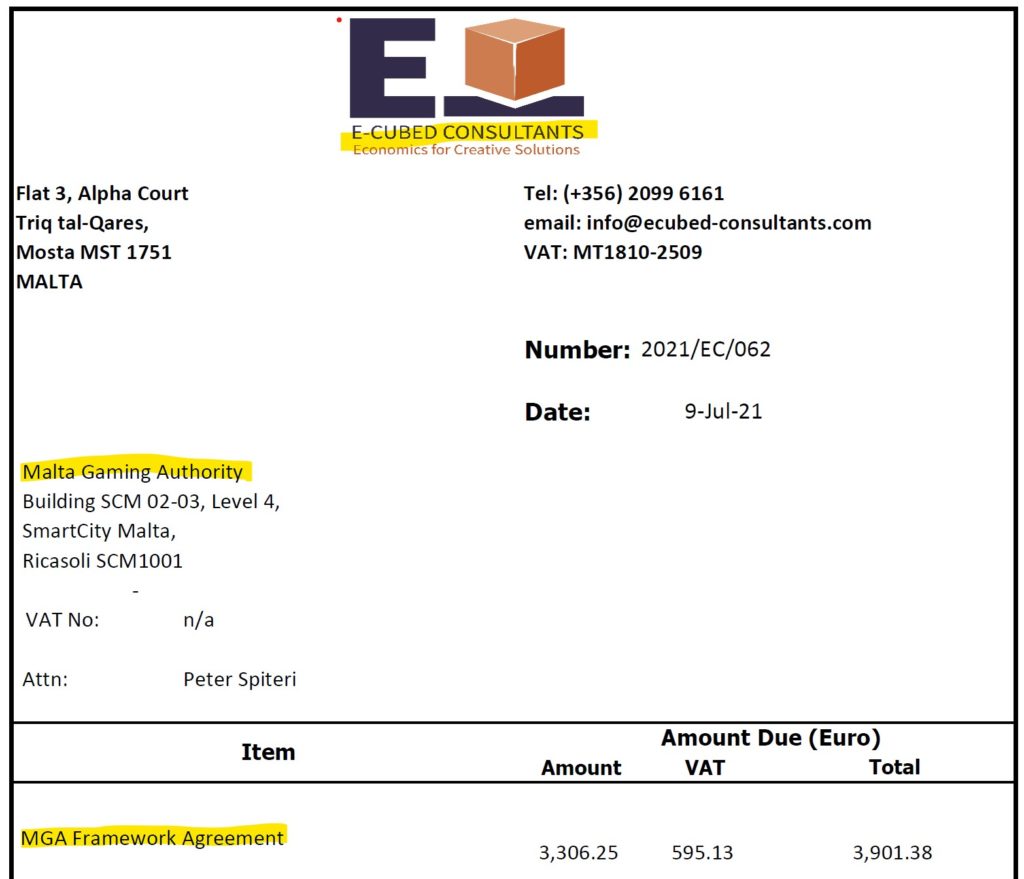

Gordon Cordina and E-Cubed Consultants charge MGA at a rate of €115 per hour for the so-called MGA Framework Agreement services, making just less than €4,000 per month from this sweet retainer. According to the invoices available to FinTelegram, Gordon Cordina himself provides part of the services to the MGA (see screenshot right). We are not aware of any other Chairman of a major bank that does such kind of personal business.

Interestingly, Cordina does not use his Bank of Valletta for his private business banking services. He opted for HSBC Bank Malta plc.

The Bank, headed by Gordon Cordina, saw its shares sliding heavily in the past years. The CEO of Malta Gaming Authority, Carl Brincat, and former MGA official Karl Brincat Peplow also hit the news for the wrong reasons after describing the due diligence of the license applicant Habanero as a “shitshow.”

It is a known fact that it is very complicated for non-Maltese citizens to open bank accounts for their newly set-up businesses at the Bank of Valletta. Gaming companies are also finding difficulties operating their bank account with Malta’s largest bank. It is unknown whether Gordon Cordina has made his possible conflict of interest known to the Bank’s shareholders.

Malta was grey-listed by the FATF in June 2021 and has since seen an exodus of licensed firms.