Especially in the so-called high-risk segments such as online gaming, online trading, porn, or events, merchants offer crypto as a payment option to their customers. From the merchants’ point of view, this is perfect because it saves them from chargeback disputes. Additionally, the flow of money is not so easy to track. FinTelegram recently warned to pay with crypto online because clients of online merchants lose their chance of a chargeback.

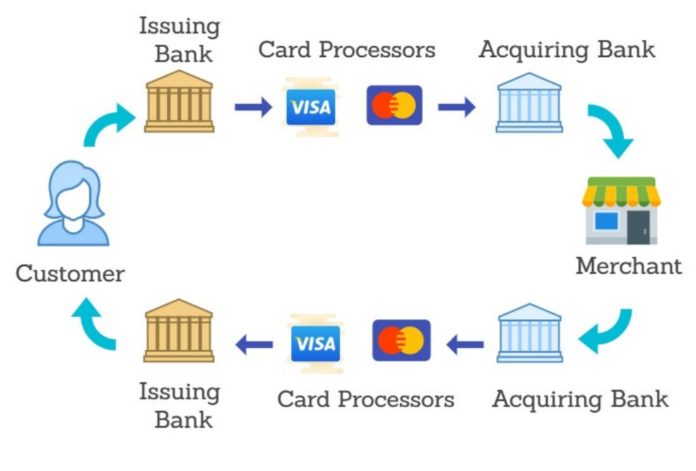

Disappointed or deceived clients have the option of a chargeback as a last resort when paying by credit card or bank transfer. A chargeback reverses a money transfer from the client’s bank account or credit card and is ordered by the card-issuing bank. A consumer can initiate a by contacting his bank (Issuing Bank) and submitting a substantiated criticism regarding a card or bank wire payment. However, the dispute initiated by clients against the seller (Merchant) is not straightforward and, unfortunately, far too often unsuccessful. The merchant can either accept the chargeback or contest it by providing proof of supply of items in question.

There is no chargeback option in the case of payments or deposits via cryptocurrencies, which is a perfect situation for the merchant!

Many high-risk merchants offer payments or deposits via credit card through crypto exchanges like Binance. We strictly advise you not to do that because you will also lose the chargeback option!